It’s tax time once again. No business owner wants an audit. Fortunately, only a fraction of small businesses get audited. Keep in mind that the IRS, and your state taxing authorities, have their hands full. And while it may seem like the case, they don’t have the time or resources to pour over the details of every return. On the other hand, you want to avoid anything that might draw attention to your return. If you own your own business, here are some quick tips to reduce your chances of the dreaded tax audit, and some red flags that might draw the IRS’s attention.

- Filing Inaccurate Numbers.

Your tax return can attract attention if your numbers don’t add up. If you are one of the few that still use manual filing, consider using tax software with electronic filing. Manual returns are more likely to contain errors (especially mathematical) and may garner closer scrutiny from the IRS. Tax software also has the additional benefit of catching errors before they are submitted. Even better, hire an accountant to review your taxes for you. Also keep in mind that if you make a mistake because you didn’t have a qualified professional to help you, the filing of an amendment puts your return in the IRS screening process twice. Take the time to do it correctly the first time.

If you do your own taxes, avoid rounding numbers. Provide the actual number. Any statement that only includes round figures ending in exact zero digits can be a red flag. If you made $800,054.28 last year, don’t report your income as $800,000. The Internal Revenue Service tends to believe that if you’re sloppy in this area, the rest of your return may not be entirely accurate. It also gives the impression you have made the number up.

- Reporting Losses Or Claiming Huge Deductions Every Year.

If you report a net loss in more than two out of five years, you may be a candidate for a tax audit. The IRS may determine that your business is a hobby and disallow all your business expense deductions. If your financial statements, profits, and expenses are inconsistent with the reasonableness of a business in your industry, that may be a red flag for investigation.

Understand the rules for taking deductions, and don’t fall into many of the classic traps. Particularly for startups with high costs in the first year, remember that not all expenses can be deduced in the first year. Some may need to be spread over the following years in the form of depreciation. Deductions for vehicle use lead to common mistakes. Be prepared to provide an accurate record of use if you attempt to claim full-time business use of a vehicle. And the most popular over-used deduction: entertainment/meals costs. Know your legal limits. Even if the expense feels as if it was made for a legitimate business purpose, the IRS may not agree. When making deductions, keep accurate records. If they are deserved, then obviously take them. Understand that if you are repeatedly taking deductions that are inconsistent with your income, industry, and/or location, that also may be a red flag for the taxing authorities.

- Pay Attention to How You Pay Your Employees.

If you have a C corporation, paying your executives a high salary can minimize corporate profits and therefore lower taxes. For this reason, unusually high salaries may become a red flag. Know what the reasonable salary range is for your industry, and your location. Paying exceptionally high salaries to shareholder/employees may get you unwanted attention.

Likewise, having a high ratio of independent contractors to employees may draw attention. As you may be aware, the use of independent contractors can be a way to avoid paying payroll taxes. The IRS has clear guidelines on who must be classified as an employee. Make sure you know and follow the rules.

- Home Office Deductions.

This year and next, with the necessity of home offices due to the COVID crisis, the IRS is likely to see a proliferation of home office deductions. Rightly so. Keep in mind that historically home offices have a bad reputation as red flags for tax audits. Consider not just the home space you came to use solely for business purposes, but how much you are attributing to maintenance and utility expenses.

- Get Incorporated and Keep Separate Bank Accounts.

Aside from the potential liability protections Corporations and LLCs offer, they have a lesser chance of getting audited by the IRS when compared to unincorporated businesses. Perhaps because incorporated entities are organized and therefore expected to have more checks and systems to ensure compliance. Consider recent date on the percentage of sole proprietors v. corporations that were audited: Sole proprietor: 2.40%; Corporation: 0.20%.

Just as you keep separate business and personal bank accounts for legal liability reasons, maintain separate business and personal bank accounts for tax purposes as well. Use your business account exclusively for the operation of your business. Not only is it good business practice to avoid tax mistakes, it makes it easier to reconcile the income and expenses of the business.

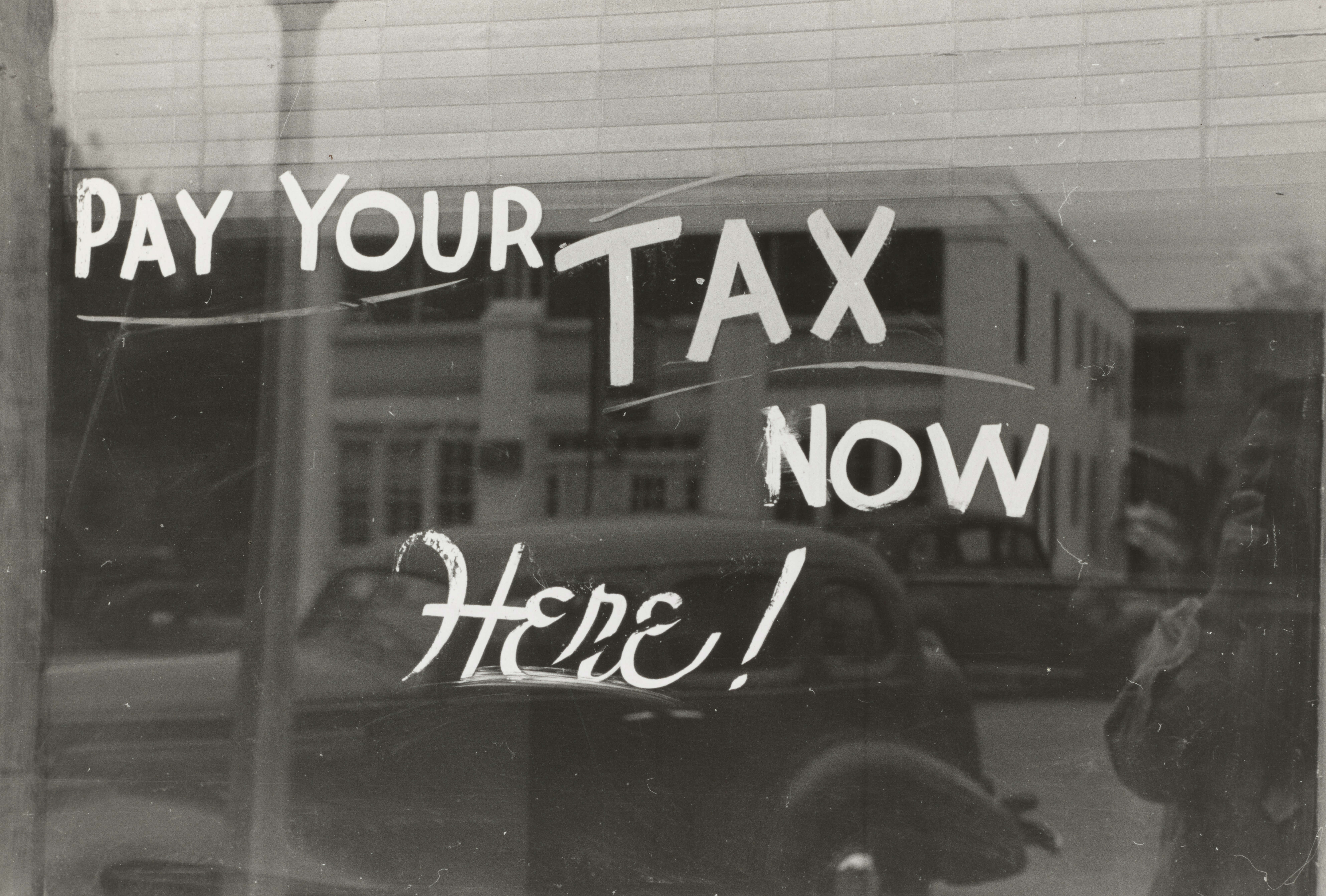

- Pay Your Estimated Quarterly Taxes.

If you only expect to owe a small amount in taxes for your business entity for any given (or even all) quarters, you should be making quarterly estimated tax payments. Failing to make these payments can be a red flag for the IRS.

- Keep good records and report income and expenses accurately.

Most importantly, keep accurate and consistent records. You may not be able to prevent an audit, but you can certainly make it less painful. If you do your own internal accounting, make sure you consistently use one accounting method – either cash or accrual. If you are switching back and forth, not only will it wreak havoc on your financial statements, but if your records appear confused, it may be a red flag during the audit process and make things even more painful.

Takeaway

Need assistance in forming or maintaining your business entity? Contact CASHMAN LAW today for a free consultation to see how we might help you with your business planning, growth, and maintenance needs.

Thank you for taking the time to read our blog. If you would like to receive notice as each new blog article is posted, fill out the “Contact Us” form and indicate in the comments section that you would like to receive an email. You will not be contacted for any other purpose, unless you specifically request it.

The contents of this blog are intended to convey general information only and not to provide legal advice or opinions. The posting and viewing of the information on this blog should not be construed as, and should not be relied upon for, legal or tax advice in any particular circumstance or fact situation. While effort is taken to update the information presented, it may not reflect the most current legal developments. Please contact CASHMAN LAW FIRM LLLC (Hawai’i)/ CASHMAN LAW LC (California) to consult with an attorney for advice on specific legal issues.